“Forex” is the informal term for the foreign currency markets, which are extremely accessible to anyone with a computer. What follows will give you a short primer on the forex markets, and the methods by which you can profit from them.

Pay attention to what is on the news, especially in the financial world, including the currencies you are trading. News items stimulate market speculation causing the currency market to rise and fall. To quickly capitalize on major news, contemplate alerting your markets with emails or text messages.

Forex trading depends on worldwide economic conditions more than the U.S. stock market, options and futures trading. Before engaging in Forex trades, learn about trade imbalances, interest rates, fiscal and monetary policy. Trading without understanding the fundamentals can be disastrous.

Discuss trading with others in the market, but be sure to follow your judgment first. Listen to other’s opinions, but it is your decision to make since it is your investment.

When trading, try to have a couple of accounts in your name. You will use one of these accounts for your actual trades, and use the other one as a test account to try out your decisions before you go through with them.

If you keep changing your stop losses, hoping that the market will rebound, chances are you’ll just lose even more money. Have a set strategy and make sure to abide by it.

Try not to set your positions according to what another forex trader has done in the past. All traders will emphasize their past successes, but that doesn’t mean that their decision now is a good one. Even though someone may seem to have many successful trades, they also have their fair share of failures. Rely on your personal strategies, your signals and your intuition, and let the other traders rely on theirs.

In order to preserve your profits and limit your losses you should understand and use margins sparingly. You can increase your profits tremendously using margin trading. While it may double or triple your profits, it may also double and triple your losses if used carelessly. Only use margin when you think that you have a stable position and that the risks of losing money is low.

You will always get better as you keep trying. By practicing live trading under real market conditions, you can get a feel for the forex market without using actual currency. You can find quite a few tutorials online that will help you learn a lot about it. Equip yourself with the right knowledge before starting a real trade.

Investing in the foreign market through Forex is a serious venture. People who are interested in forex for the thrill of making huge profits quickly are misinformed. Those who think that Forex is a game might be better going to the casino with their money.

Do not expect to forge your own private, novel path to forex success. Financial experts have studied forex for years, due to its complexities. As nice as it sounds in theory, odds are you are not going to magically come up with some foolproof new method that will reap you millions in profits. Research successful strategies and use them.

You are not required to buy any software or spend any money to open a demo forex account and start practice-trading. You can find a demo account on the Forex main website.

First set up a mini-account and do small trading for a year or so. This will establish you for success in Forex. You need to be able to tell good and bad trades apart, and a mini account will help you learn to differentiate them.

Learn how to get a pulse on the market and decipher information to draw conclusions on your own. This is the best way to attain success with Forex trading and earn the income you covet.

Experienced Traders

Beginning traders should not trade against the forex market. Even experienced traders should be financially secure and also have plenty of patience if they do. Beginners should never trade against the market, and even experienced traders should shy away from fighting trends since this method is often unsuccessful and extremely stressful.

When you are just starting out in Forex trading, avoid getting caught up with trades in multiple markets. Stick to the major currency pairs. Having your hands in too many different markets can lead to confusion. If you do not, you could end up making careless or reckless trading decisions, which can be detrimental to your success.

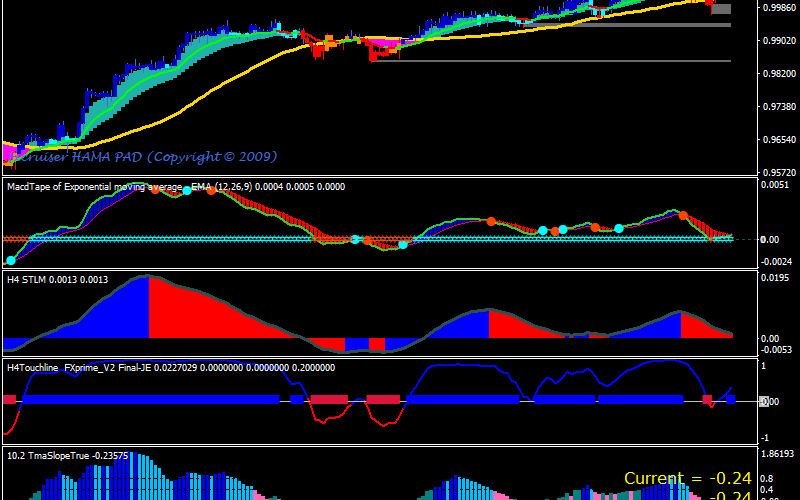

Exchange market signals are useful tools for buying and selling. Software exists that helps to track this information for you. There’s special alerts you can set that will tell you when a goal rate is acquired. By carefully planning your entry point and exit point, you’ll be able to act without wasting time when the points are reached.

To get information on the gain and loss averages of a market, you can use an indicator called RSI or relative strength index. It may not be a full reflection on your investment, but it will give you a good sense of a market’s true potential. Do your research before you invest, and find profitable markets.

You will not learn everything there is to know about trading overnight. You will lose money if you are not willing to persevere through difficult times.

As stated before you can use the Forex market to buy, exchange and trade currency internationally. If you heed the advice presented above, and proceed with caution and good judgement, you may find yourself earning a notable amount of money through savvy forex trading.