Like it or not, most people fail to profit when they begin trading in Forex. Whether it’s because they take too much of a risk or simply because they do not understand the market, upwards of 85% of all investors lose their money over time. Do not become part of the majority. Do what the minority is doing: learning about Forex before making the first trade. This article will shed light on a lot of Forex tips and tactics you need to experience success while trading.

After becoming familiar with the forex market’s peculiarities a successful trader may have surplus cash on hand. It is vital to manage these profits carefully. The nature of the forex market dictates that yesterday’s profits may be cancelled out by tomorrow’s losses. Handling profits prudently can protect a forex trader from the vicissitudes of the market.

To get the most out of the forex market, do not rely too much on advice from other traders. Fellow traders see all the same information you see. They have no secret, privileged information to give you. Ultimately you will find it far more profitable to learn how to interpret the market information yourself rather than to rely on the questionable interpretations of other traders.

While the Forex Market runs around the clock and is always open, there are strategies in timing that you need to be aware of while trading on Forex. Understanding Forex hours will help you maximize your strategies by trading when there is high potential for winning a profit.

Make a trading plan and stick to it. Even if you are only dabbling in the Forex market, you should have a plan, a business model and time-tables charting your goals. If you trade without these preparations, you leave yourself open to making aimless, undirected trades. When you trade as the mood strikes you, you will frequently pile up losses and rarely reap satisfactory profits.

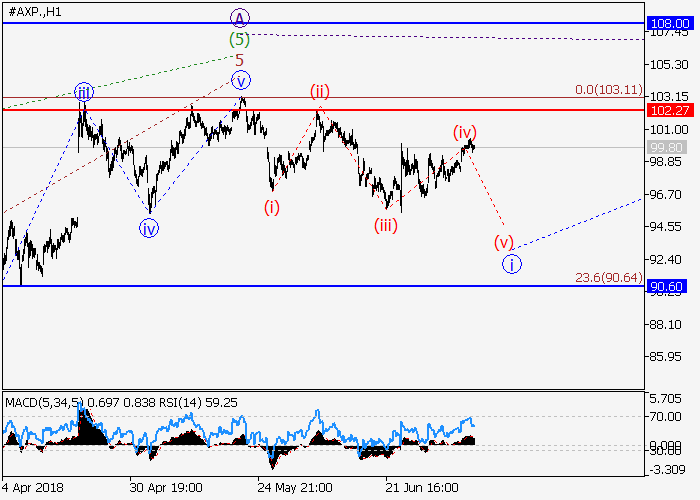

Keep your eyes on the real-time market charts. These days, the Forex market can be charted on intervals as short as fifteen minutes. However, short-term cycles like these fluctuate too much and are too random to be of much use. Cut down on unnecessary tension and inflated expectations by using longer cycles.

Make sure you choose a time to trade that works for you. Trading when you are overly tired or stressed is never a good idea. You will not want to take the time to make sure you are doing the best thing with your money. Choose a time when you have the energy and concentration that you need to succeed.

When forex trading, you need to trust your instincts and ultimately, make your own decision. It’s wise to get advice from critics and knowledgeable people, but ultimately the decision should be up to you. You don’t want other people making major trading decisions with your money.

Obviously, you’re not going to learn everything about the Forex market in one article. This article sheds light on a lot of Forex tips and tactics, but you need to keep learning if you expect to experience success while trading. Keep your ear to the ground and keep learning how to trade and you will do just fine.